Loan Verification

Loan verification is the foundation of secure lending facilities, yet manual verification processes create bottlenecks, introduce errors, and limit scalability. Cascade's Document Verification solution addresses these challenges through advanced OCR technology and automated cross-checking that validates every new loan assignment against facility eligibility criteria before it enters the borrowing base.

As the first step in the master servicing workflow, Cascade's Document Verification provides lenders with confidence through comprehensive multi-document cross-validation while delivering originators the scalability needed to grow without proportionally increasing operational costs. The system processes hundreds of documents in minutes, performs systematic consistency checks across all data sources, and directly drives borrowing base calculations with full audit trails.

Key Outcomes:

- For Lenders: Verified collateral quality, fraud prevention, and real-time borrowing base integrity

- For Originators: Rapid eligibility decisions, high-volume processing, and reduced operational friction

- For Both: Transparent, auditable documentation status for every loan in the facility

The Challenge: Loan Verification in Structured Finance

The Critical Role of Documentation

In asset-backed lending facilities, the borrowing base determines how much capital an originator can access. This calculation depends entirely on the eligibility of pledged collateral—and eligibility can only be confirmed through thorough document verification. Without proper documentation review:

- Lenders face risk: Unverified or incomplete documentation can result in inflated borrowing bases, exposing lenders to collateral that doesn't meet facility requirements

- Originators face delays: Manual document review creates bottlenecks that delay access to funding and limit growth potential

- Both face disputes: Inconsistent verification standards lead to disagreements about eligibility determinations

The Traditional Approach Falls Short

Manual document verification processes suffer from fundamental limitations:

- Scalability constraints: Human reviewers can only process a limited number of loan packages per day

- Inconsistent standards: Different reviewers may interpret eligibility criteria differently

- Error-prone data entry: Manual transcription of document data introduces mistakes

- Slow turnaround times: Days or weeks to complete verification creates cash flow challenges for originators

- Limited cross-checking: Manual review rarely validates consistency across all documents systematically

The Document Verification Dilemma

Lenders need rigorous verification to protect their capital. Originators need rapid processing to access funding quickly. Traditional approaches force a trade-off between thoroughness and speed. The structured finance industry needs a solution that delivers both.

The Cascade Solution

Cascade's Document Verification eliminates the trade-off between thoroughness and speed through intelligent automation. Our platform serves as the first line of defense in the master servicing workflow, ensuring that only properly documented, fully verified loans enter the borrowing base.

How It Works: The Three-Layer Verification Process

Layer 1: Intelligent Document Processing

Advanced OCR technology automatically extracts data from all document types:

- Credit reports and FICO scores

- Employment verification letters

- Government-issued identification (driver's licenses, passports)

- Loan agreements and promissory notes

- Title documents, insurance policies, and invoices

- Any other collateral documentation

The system processes multiple formats (PDF, JPG, PNG, scanned images) with high accuracy, eliminating manual data entry, and the errors that come with it.

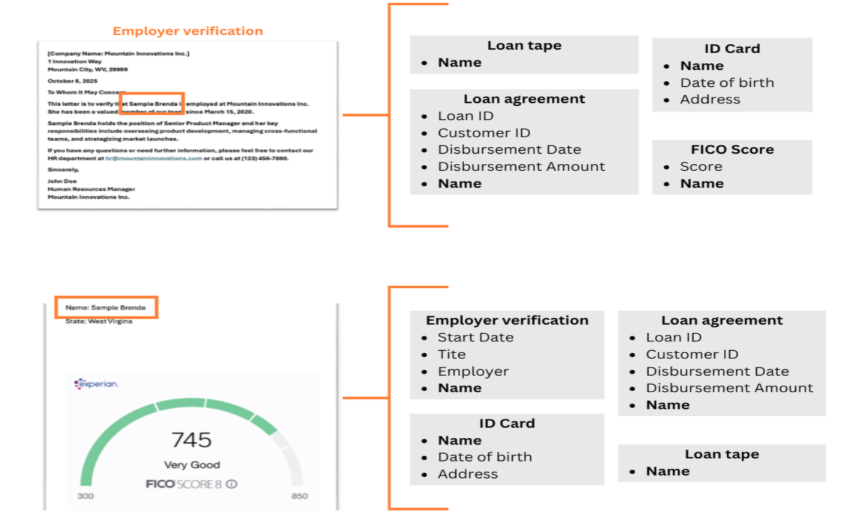

Layer 2: Comprehensive Cross-Validation

Extracted data undergoes systematic cross-checking across all documents to verify consistency:

- Identity Verification: Full legal names are matched across all documents (driver's license, credit report, loan agreement, employment letter) to ensure consistency

- Address Validation: Physical addresses are compared across multiple sources to confirm residency and detect discrepancies

- Employment Confirmation: Employer information, position, start dates, and locations are verified and cross-referenced

- Credit Data Matching: Credit scores and bureau information are validated against borrower identity

- Date of Birth Consistency: DOB is confirmed across identification documents and loan agreements

- Account Linkage: Loan account numbers are verified between loan agreements and loan tape records

These automated checks detect inconsistencies that might indicate data quality issues or fraud—issues that manual reviewers often miss.

Layer 3: Eligibility Criteria Validation

Validated data is compared against facility-specific eligibility requirements defined in the loan agreement:

- Credit Quality Thresholds: Minimum FICO scores, credit bureau requirements, and credit history standards

- Geographic Restrictions: Approved states or regions, excluded jurisdictions

- Employment Verification: Documentation requirements, income thresholds, employment stability criteria

- Asset Categories: Loan types, product categories, and asset specifications

- Documentation Completeness: Full package requirements, mandatory document checklist

- Any Other Criteria: Facility-specific rules and requirements defined in loan agreement schedules or exhibits

By automating verification against pre-agreed criteria, Cascade ensures that eligibility determinations are consistent, objective, and aligned with the terms both lenders and originators have contractually established.

The Outcome: Instant Eligibility Determination

Within seconds, each loan receives a clear classification:

- ELIGIBLE: All documents present, data consistent, criteria met → Included in borrowing base

- INELIGIBLE: Missing documents, data discrepancies, or criteria failures → Excluded from borrowing base with detailed reason codes

This binary determination provides clarity for both lenders and originators, eliminating ambiguity in borrowing base calculations.

Key Benefits

For Lenders:

- Verified Collateral Quality: Multi-document cross-checking detects fraud, errors, and inconsistencies before loans enter the borrowing base

- Real-Time Borrowing Base Integrity: Only verified, eligible collateral included in calculations with continuous visibility into collateral quality

- Complete Audit Trail: All OCR extractions, cross-check results, and eligibility assessments stored with timestamps for regulators and auditors

- Consistent Standards: Automated verification applies eligibility criteria uniformly across all loans, eliminating subjectivity

For Originators:

- Rapid Eligibility Decisions: Processing in minutes instead of days accelerates access to borrowing capacity and improves cash flow

- High-Volume Scalability: Handle hundreds or thousands of pledges without increasing manual review time or operational costs

- Exception Management: Clear, specific reason codes for ineligible loans enable fast remediation (e.g., "Missing Employment Verification," "Credit Score Below Minimum")

- Predictable Outcomes: Consistent application of standards reduces disputes about borrowing base calculations

For Both:

- Real-Time Dashboards: Continuous visibility into eligible vs. ineligible breakdown, borrowing base summary, eligibility trends, and reason code distribution

- Remediation Tracking: Monitor progress as documentation is corrected with aging reports and priority alerts for high-value ineligible loans

- Operational Efficiency: Single-pass verification eliminates multiple rounds of document requests and reduces back-and-forth

- Portfolio Insights: Identify systemic documentation issues early and track remediation efficiency to improve origination processes

- Compliance Ready: Complete documentation record with status change history and eligibility criteria versioning available on demand

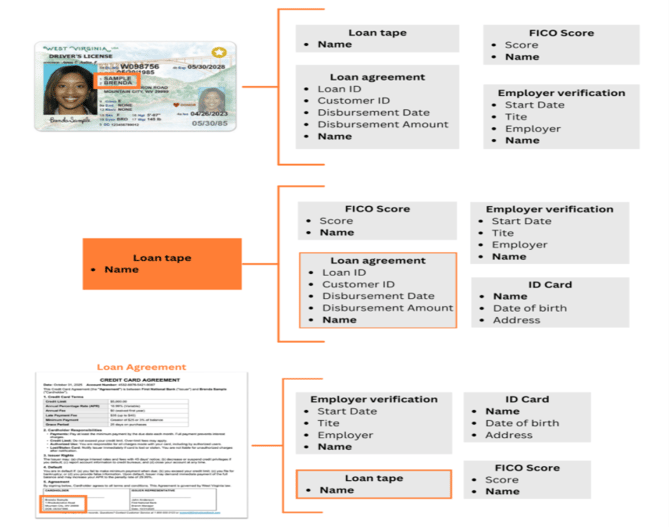

Demonstration: Consumer Loan Verification Process

The following demonstration illustrates how Cascade's Document Verification system processes a consumer loan application. This example uses fictional data to show the extraction, cross-validation, and eligibility determination workflow.

Note: All data, documents, and borrower information in this example are fabricated for demonstration purposes only.

Document Package Submitted

The following documents were submitted as part of the new loan pledge, in accordance with the documentation requirements pre-agreed between the lender and originator in the facility's term sheet:

- FICO Credit Report – Required to verify the borrower meets the minimum credit score threshold of 700

- Employment Verification Letter – Required to confirm stable employment and validate borrower identity

- Driver's License – Required to verify borrower identity, confirm date of birth, validate residential address, and establish geographic eligibility

- Loan Agreement – Required to document loan terms, borrower details, and account information

These four documents represent the complete documentation package as defined in the facility's credit underwriting policy. Each document serves a specific verification purpose tied to the eligibility criteria that both lender and originator have contractually agreed upon. Cascade's system validates that all required documents are present before proceeding with data extraction and cross-validation.

Data Extracted via OCR:

Automated Cross-Validation Results

|

Validation Check |

Documents Cross-Checked |

Result |

Details |

|

Name Consistency |

FICO Report, Employment Letter, Driver's License, Loan Agreement |

PASS |

"Sample Brenda" matches exactly across all documents |

|

Address Consistency |

Driver's License, Loan Agreement |

PASS |

"1 Rhododendron Road, Mountain City, WV 29999" matches |

|

Date of Birth |

Driver's License, Loan Agreement |

PASS |

"05/30/1985" confirmed across documents |

|

State Consistency |

FICO Report, Employment Letter, Driver's License |

PASS |

West Virginia confirmed across all location references |

|

Employment-Residence Alignment |

Employment Letter, Driver's License |

PASS |

Employer location (Mountain City, WV) aligns with residence |

Eligibility Criteria Validation (Sample Facility Requirements)

|

Eligibility Criterion |

Required |

Actual |

Result |

|

Minimum Credit Score |

≥ 700 |

745 |

PASS |

|

Geographic Eligibility |

West Virginia Approved |

West Virginia |

PASS |

|

Employment Verification |

Required |

Verified |

PASS |

|

Documentation Completeness |

All Documents Required |

All Present |

PASS |

Final Determination: ELIGIBLE

Processing Time: 3 minutes

Result: Loan included in borrowing base calculation at full eligible value

Audit Trail: All extracted data, cross-check results, and eligibility validation stored for future reference

Implementation Process

Cascade follows a structured onboarding approach for Document Verification services:

Step 1: Document Discovery & Mapping

- Initial consultation to understand facility structure and collateral types

- Collection of sample collateral documents (minimum 10-20 representative samples)

- Review of loan agreement eligibility criteria and schedules

- Identification of key data fields to be extracted and validated

Step 2: OCR Configuration & Testing

- Configuration of OCR extraction templates for specific document types

- Development of data validation rules based on loan agreement criteria

- Creation of cross-check logic between documents and loan tapes

- Initial testing with sample documents to refine accuracy

Step 3: Integration & Data Format Alignment

- Configuration of automated matching algorithms

- Development of exception handling workflows

- Creation of reporting templates and dashboard views

Step 4: User Acceptance Testing

- Processing of test batch with real sample documents

- Validation of extraction accuracy and matching logic

- Review and approval of reports and exception handling

- Training on document submission process

- Final sign-off and go-live preparation

Conclusion

Document Verification is the foundation of secure, scalable asset-backed lending. Traditional manual processes force lenders and originators to choose between thoroughness and speed, creating bottlenecks that limit growth while introducing risk.

Cascade's Document Verification solution eliminates this trade-off through intelligent automation. By serving as the first step in the master servicing workflow, our platform ensures that only properly documented, fully verified loans enter the borrowing base—giving lenders confidence in collateral quality while enabling originators to scale operations without constraint.

The result is a win-win:

- Lenders gain verified collateral, fraud detection, and real-time borrowing base integrity

- Originators gain rapid processing, high-volume capacity, and reduced operational friction

- Both gain transparency, consistency, and complete audit trails

As structured finance continues to evolve toward greater automation and efficiency, document verification will remain the critical first line of defense. Cascade provides the technology infrastructure to make that defense both rigorous and scalable.